April is Financial Literacy Month and CNBC is featuring advice from our contributors and frequent guests. Here's how they think about financial literacy and its impact on their lives and future generations of American consumers, savers and investors.

Tampa Bay Buccaneers Super Bowl champion and investor Ndamukong Suh is successful on and off the field. The former All-American lineman has invested in over 30 companies, including Oura Ring, and he is a firm believer that financial literacy is the foundation for financial knowledge and thinks it should be taught in schools.

"Financial literacy definitely needs to be in the school system. I wish I had it when I was growing up. It's important for our youth to learn that at an early age because it becomes very prevalent in their life ... whether it's renting a car, leasing a car, buying a car, looking for your first home or looking for your first apartment and understanding your credit as a part of those different decisions. If you don't have that basic foundation and that knowledge, you're not going to be able to succeed in life."

Currently, there are no federal guidelines for personal finance education in schools, which means it's up to individual states to set their own rules. There are 23 states that mandate a personal finance course for students, according to the 2022 Survey of the States from the Council for Economic Education.

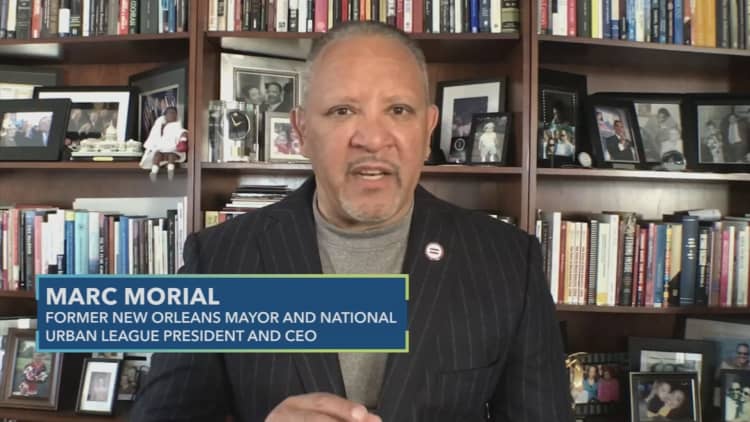

Being financially literate is empowering because it allows people to make informed decisions when deciding how to use their hard-earned money, says Marc Morial, the former mayor of New Orleans and National Urban League President and CEO. But he prefers to use the term "financial empowerment."

"Here at the National Urban League, we prefer the term financial empowerment to the term financial literacy because most Americans, they do understand and know about money, and they do have a basic understanding of the financial system. They are not empowered fully to confront the complexities. So, we like to talk about the goal. And the goal is for people to be financially empowered."

CNBC contributor Josh Brown spends a lot of his time talking about money on CNBC. For Brown, being financially literate means freedom.

"The freedom to choose how we want to live our lives, what we want to spend our money on, how we want to prioritize enjoying today, versus being prepared for tomorrow. The more you understand about how banks work, how credit works, how long-term investing works, the difference between trading and investing money in general, the more freedom you'll end up with. That's why it's so important that people take this seriously."

CNBC contributor Karen Finerman believes that financial literacy is important because it improves the overall economy.

"Financial literacy is so important to the overall U.S. economy and development because we're all players in that economy. And if we don't even speak the language, then how can we help develop that economy and develop ourselves and our own role in it?"

Jack Kosakowski is on a mission to increase financial education among young people. As the president and CEO of Junior Achievement USA, he helps young people across the country gain the knowledge they need to manage their finances.

"At Junior Achievement, we believe that all schools should be teaching young people about money and savings at very early ages, and it builds up. Like most other subjects students take in school, you don't all of a sudden advance to a master class without having the underpinnings of knowledge. We feel strongly that young people need to be exposed at a very early age about managing money and all the things that go into budgeting and finance."

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox. For the Spanish version Dinero 101, click here.

CHECK OUT: Meet a 26-year-old who earns $30,000 a month in ‘mostly passive’ income and built a $1.3 million net worth with Acorns+CNBC

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.